Understanding Accounting, Finance, Audit, Tax, and Company Registration in Nepal

Running a business in Nepal requires a solid understanding of accounting, finance, auditing, taxation, and company registration. These core areas ensure transparency, legal compliance, and financial sustainability. Whether you’re a startup, NGO, or established company, knowing how these functions work can help you make smarter business decisions and avoid regulatory issues.

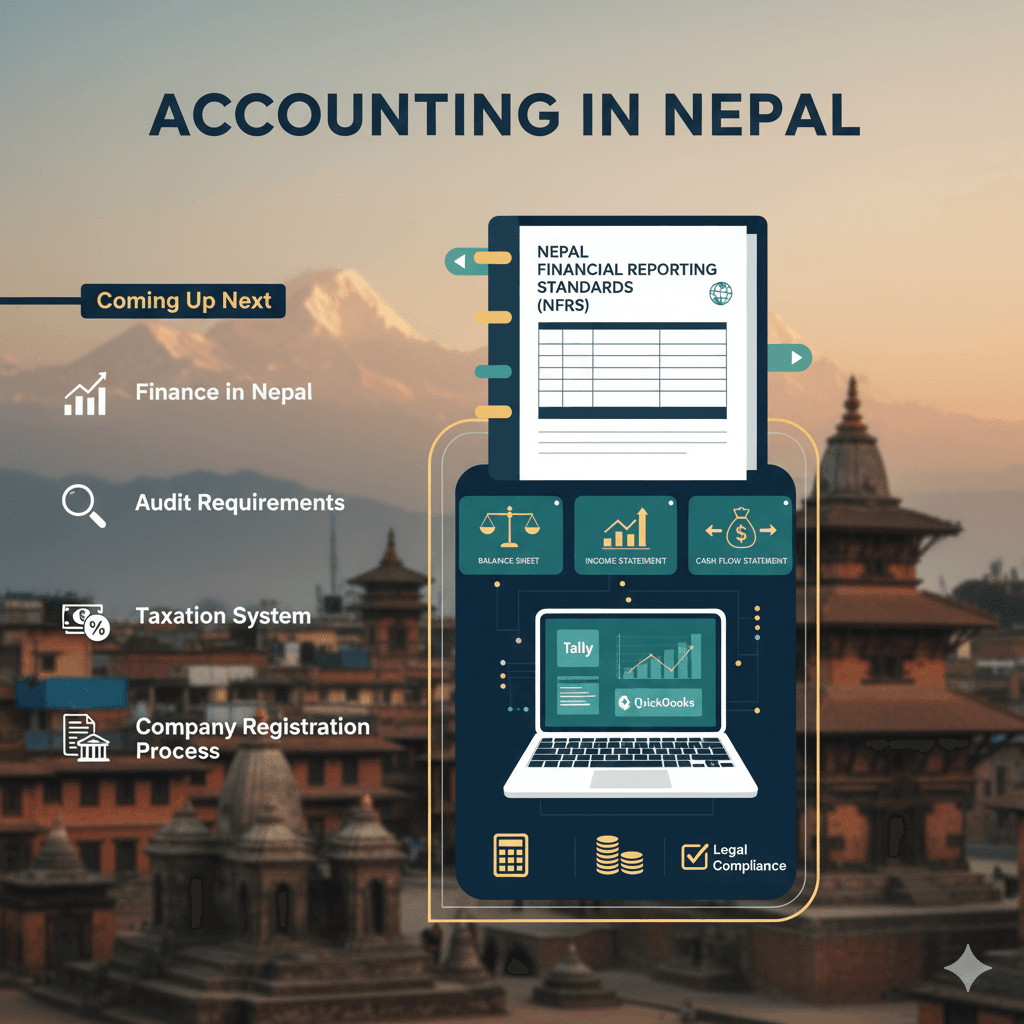

Accounting in Nepal

Accounting is the backbone of every business operation in Nepal. It involves recording, classifying, and summarizing all financial transactions to provide accurate information for decision-making. Proper accounting not only reflects a company’s performance but also ensures compliance with Nepal’s tax and financial laws.

Key Features of Accounting Practices in Nepal

-

Compliance with NFRS

Businesses in Nepal follow the Nepal Financial Reporting Standards (NFRS), which are harmonized with international accounting standards (IFRS). This ensures financial transparency and global comparability. -

Daily Transaction Recording

Maintaining daily books of accounts—including sales, purchases, expenses, and receipts—is crucial for accuracy and legal compliance. -

Preparation of Financial Statements

Every business should prepare key financial statements:-

Balance Sheet – Shows assets, liabilities, and equity.

-

Income Statement (Profit & Loss Account) – Tracks revenue and expenses.

-

Cash Flow Statement – Monitors cash inflows and outflows.

-

-

Use of Accounting Software

Modern businesses in Nepal increasingly use accounting software like Tally, Swastik, and QuickBooks for accuracy, efficiency, and audit readiness. -

Regulatory Compliance

Proper bookkeeping helps ensure compliance with tax regulations, supports audits, and enhances credibility with stakeholders.

Why Proper Accounting Matters

-

Legal Compliance: Prevents tax penalties and audit risks.

-

Financial Clarity: Helps owners make informed business decisions.

-

Investor Confidence: Transparent records attract potential investors and partners.

-

Operational Efficiency: Identifies cost-saving opportunities and inefficiencies.

Coming Up Next:

In upcoming sections, we’ll explore:

-

Finance in Nepal – Managing funds, budgeting, and investment.

-

Audit Requirements – Ensuring accuracy and accountability.

-

Taxation System – Understanding VAT, income tax, and corporate taxes.

-

Company Registration Process – Steps to officially establish your business in Nepal.

About the Author

Global Touch

Recent Articles

Audit Requirements in Nepal: Ensuring Transparency and Accountability

Oct 31, 2025, 3:49 AM

Finance Management in Nepal: Building Sustainable Business Growth

Oct 31, 2025, 3:48 AM

Understanding Accounting, Finance, Audit, Tax, and Company Registration in Nepal

Oct 31, 2025, 3:45 AM

Nepal’s NGO Sector at a Crossroads Amid Shrinking Aid

Oct 30, 2025, 1:58 PM

Deadline Extended for Income Statement Submission

Oct 30, 2025, 1:48 PM

Need Expert Guidance?

Our team of specialists can help you navigate complex financial and regulatory challenges.

Stay Up to Date

Subscribe to our newsletter to receive the latest tax and financial updates directly to your inbox.